[SMM Analysis] Is the downstream demand still performing well amid the continuous inventory drawdown of Ningbo HRC?

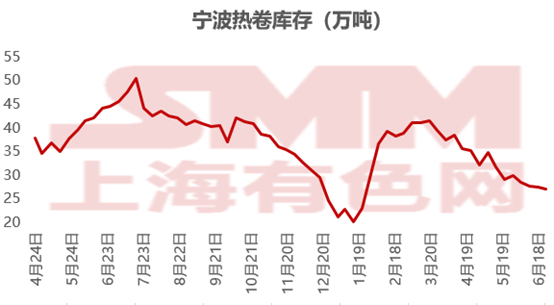

According to the SMM survey, the large-caliber inventory of Ningbo HRC was 269,300 mt (as of June 25) this week, with a WoW decrease of 4,700 mt.

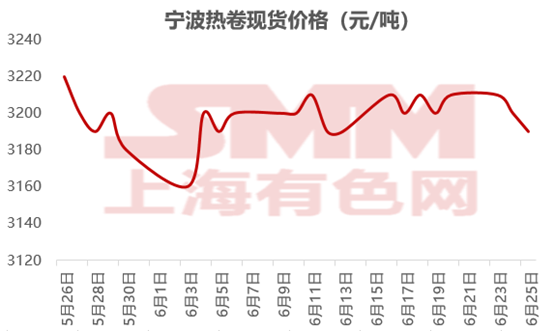

This week, the HRC futures market continued to exhibit a fluctuating trend, with macroeconomic factors remaining relatively neutral during the week, leading to rangebound price fluctuations. As of the afternoon close on June 26, the most-traded HRC 2510 futures contract closed at 3,103 yuan/mt. This week, spot prices in major cities fluctuated and fell, with prices decreasing by 10-40 yuan/mt compared to last Thursday.

Meanwhile, according to the SMM survey, in the Ningbo spot trading market this week, in terms of prices, the transaction prices of mainstream HRC resources dropped slightly. As of the afternoon of June 26, the closing spot quotations were 3,190-3,200 yuan/mt, a decrease of 10 yuan/mt compared to 3,200 yuan/mt last Thursday. In terms of transactions, although the futures market did not show a significant weakening trend, and some traders were refusing to budge on prices for their earlier spot cargoes, after mediocre transactions during the week, they had to lower prices to facilitate transactions. Therefore, the overall market transactions were mostly 10-20 yuan/mt lower than the mainstream quotations. In terms of inventory, the inventory drawdown of Ningbo HRC continued this week. According to the current SMM survey, the downstream transaction willingness in the market was not high. Meanwhile, due to the combination of high temperatures and rainy weather, the infrastructure industry significantly weakened, and transactions of low-alloy HRC also entered the off-season, with sluggish shipments. In terms of arrivals, the current volume of mainstream agreed-upon cargoes from NG remained relatively normal. Although the cargo supply from DDH had improved compared to previous arrivals, the overall cargo volume did not show significant growth. The main reason was that the prices in the South China market were relatively more advantageous than those in the Ningbo market earlier, leading to a significant decrease in shipment arrivals. Now, the prices in the two markets have become similar. Moreover, according to the SMM's large-sample social inventory data, the South China market has started inventory buildup, and the inventory buildup speed in north China has also accelerated significantly. Therefore, considering the subsequent development of supply and the gradual deepening of the off-season impact, it is difficult to expect an improvement in demand. Thus, it is anticipated that the risk of inventory buildup for Ningbo HRC will increase, and it is expected to start entering the inventory buildup phase within two weeks. It is worth noting that although the risk of inventory buildup is increasing, the overall large-sample inventory level of Ningbo HRC is still in a relatively good position compared to the same period last year. Therefore, overall, the prices of Ningbo HRC still have support. Compared to northeast and north China, the price advantages still exist, and the resilience is relatively strong.

This week, the SMM released the weekly balance data from the survey, showing that some steel mills had completed maintenance, and HRC production continued to increase MoM. This week, the SMM-tracked social inventory of HRC in 86 warehouses nationwide (large sample) was 3.0017 million mt, with a MoM increase of 22,200 mt, or 0.75%, and a YoY decrease of 27.00% on the new calendar basis. This week, social inventory nationwide began to build up. By region, except for east China, which continued destocking, inventory in central, southern, northern, and north-east China regions was all accumulating.

![The most-traded BC copper contract closed down 2.85%, as speculative fervor cooled, weighing on copper prices [SMM BC Copper Review]](https://imgqn.smm.cn/usercenter/CYktX20251217171711.jpg)

![The Black Industrial Chain Lacked Upward or Downward Momentum Before the Holiday [SMM Steel Industry Chain Weekly Report]](https://imgqn.smm.cn/usercenter/FRcmT20251217171746.jpg)

![The most-traded SHFE tin contract plummeted more than 8% in a single day, and tin prices are expected to remain in the doldrums in the short term [SMM Tin Futures Review]](https://imgqn.smm.cn/usercenter/LLUUJ20251217171751.jpeg)